Articles

Mitigating COVID-19 Risks When Returning To The Workplace

July 2020

Research by professional services firm PwC shows many businesses are gearing up to support staff towards a partial or full return to the office. But how people work will now be very different.

According to its research, 50 per cent of organisations surveyed say staff will expect higher protections at work when they return to the office, while 67 per cent have established ways to track the location of their staff and remote ways of working.

Click here to read more

5 smart new ways to prevent your tools from being stolen

June 2020

One of the most common insurance claims we are seeing are stolen tools from either job-sites, back of utes, or even being mistakenly taken by another contractor.

Not only is having your tools stolen a considerable inconvenience, there is a financial impact on both replacing the tools and also the difficulty for you to complete current jobs and pick up new ones.

If your business relies on tools of your trade, we have 5 ways to protect your tools from being stolen, help you recover them, and potentially reduce your insurance premium.

Click here to read more

How to protect your business against non-compliant cladding

March 2019

The UK Grenfell Tower disaster claimed the lives of 72 people on 14 June 2017.

The tragedy unfolded on television and computer screens around the globe, serving as a sharp and tragic wake-up call to governments and regulators around the world that cheap, non-compliant cladding materials could create devastating fire hazards for high rise buildings.

Click here to read more.

Why your business needs an extreme weather action plan

March 2019

Extreme weather conditions are increasing around the world, and Australia is no exception. Experts predict this summer will, again, be one of the hottest on record, with severe bushfires, storms and floods all set to increase.

In the absence of the vast resources of larger organisations, there is an urgent need for small businesses to have specific plans in place.

Click here to read more.

Your small business insurance needs for 2019

March 2019

New Year, new you, right?

Well, when it comes to your business, it's more a case of: New Year, new risks.

If you're looking for a New Year's resolution for your business, here are five trending risks where you should consider insurance cover to get your business insurance on track for the year ahead.

Click here to read more.

Life Insurance- Claims story

March 2019

In this edition of the newsletter we would like to share a life insurance claims story. Tania and her husband Marty came to us unsure what they needed but were concerned about protecting their family in case of ill health. Our adviser Tanuja Pirie, advised them of their options and helped them implement the policies that they selected. Less than 12 months later Tania was diagnosed with a severe brain tumour.

Click here to read more.

Banks vs. Mortgage Brokers: Who Should You Choose?

March 2019

One of the first challenges facing you as a prospective buyer (as if there weren't enough already), is choosing whether to negotiate your mortgage through a mortgage broker or a bank.

Click here to read more.

Do you have a Self-Managed Superannuation Fund?

30 Nov 2018

The ATO is targeting SMSFs and the Trustees by RANDOM AUDITS and CROSS REFERENCING all of the client’s tax entities.

You may think your accountant is able to guide you through the ‘quagmire’ of superannuation legislation – they MAY be able to… IF…... they FULLY understand the Regulations. BUT……

IF something IS wrong YOU THE TRUSTEE/S are UTIMATELY RESPONSIBLE, no one else…... the ATO will penalise YOU.

Click here to read more.

How to minimise being underinsured

12 Oct 2018

Many Australians, especially those who own businesses, discover they don’t have the cover they need in the worst possible circumstances.

Insurance is one of those subjects that many people glaze over. So, just to test how knowledgeable you are about this important but unsexy topic, see how many of the following questions you can answer.

Click here to read more.

What insurance cover does a growing business need?

12 Oct 2018

A growing business usually requires a growing workforce. With more equipment and larger premises come more expensive rent payments. In such circumstances, any revenue-disrupting interruption to its activities can soon escalate into a cashflow crisis.

Click here to read more.

Why you should embrace the New Payment Platform

12 Oct 2018

Despite some attention-grabbing ads featuring a man sporting the head of a goldfish, the launch of the New Payment Platform (NPP) earlier this year failed to attract much attention. That’s regrettable given it is a game-changing innovation on par with the introduction of mass-market credit cards (1974), EFTPOS (1983) and BPAY (1997).

What’s new about the New Payment Platform?

Click here to read more.

Innovate Your Way to Growth

9 May 2018

Innovation conjures up images of geeks in garages, but it's not restricted to tech start-ups. It's a way of doing business that any SME can emulate by tapping into Australia's rapidly expanding innovation ecosystem.

Click here to read more.

Why Do Small Businesses Use an Insurance Broker

9 May 2018

Small business owners tend to be born optimists with little inclination to think about what could go wrong. That’s why it pays to have an insurance broker in your corner to safeguard what you’ve worked for.

Click here to read more.

How Social Media Can Help Regional Businesses Reach Out

9 May 2018

If your regional business isn’t hitting it hard on social media, you may be missing out on an opportunity to expand your market.

Click here to read more.

Five tips to protect against ransomware attacks

14 December 2017

Ransomware attacks are one of the most common forms of cyber attack in Australia. How can you protect your business?

Ransomware hackers steal businesses’ files and demand ransom payments to get them back. The attacks can be devastating financially for companies that are not prepared.

For example, the WannaCry attack hit 200,000 victims in 150 countries.

f you run a business, follow these five tips to safeguard yourself and your business against such attacks.

1. Update your software

Pay close attention to the software you use. Emergence Insurance recommends you always accept options to update or patch your operating system and other key applications immediately updates are available. Updates are often designed to strengthen cyber security.

2. Install antivirus software

Regular software updates alone do not ensure your systems are protected. Viruses are still a threat because they constantly evolve. Guard against them by running a reputable antivirus tool and update your software immediately updates are available.

3. Use common sense on the internet

Be smart about not exposing yourself to cyber attacks. Think before you click on unfamiliar links. Don’t open strange email attachments. Delete all emails that look suspicious.

4. Backup your files often

Create backups of all your files often. It’s a simple, effective way to ensure that if ransomware thieves steal your files and hold them hostage, the thieves have no leverage against you.

5. Develop a cyber security plan

Develop a long-term plan to strengthen your business’s cyber security. It should include educating your employees; upgrading hardware and software; building a business continuity plan; and buying cyber insurance protection to safeguard your business financially in the event of a cyber attack.

Emergence Insurance is here to protect all businesses – large and small – against cyber risks. In fact, that’s all we do, so we’re the specialists in the field.

Talk to your insurance broker about how Emergence can develop a cyber solution for your business.

Management Liability Insurance

Don't leave you and your company exposed!

Today’s Companies and their Directors face many exposures relating to the management of their business including:

- Allegations of improper business conduct by competitors, customers, fellow directors and others.

- Breach of employee rights,

- Breach of statutes such as Workplace Health and Safety,

- Loss incurred from fraud perpetrated from within or outside the Company.

Management Liability Insurance protects you and the Company against the risks and exposures of running the Company. Without adequate protection you could risk losing, not only your business, but also your personal assets.

We strongly recommend you consider a Management Liability policy as part of your insurance portfolio.

What are the consequences of a non-disclosure?

The rights which the insurer has, as a result of a non-disclosure of a relevant fact are set out in section 21 and section 60(b) Insurance Contracts Act.

Section 28(2) allows an insurer to avoid a contract if the non-disclosure was fraudulent. It is very difficult for an insurer to prove that a non-disclosure was fraudulent and this section rarely comes up.

Section 60(2) allows an insurer to cancel a policy on the grounds of non-disclosure. This is straight forward.

However, the most common situation which we would see arise is for the insurer to rely on section 28(3) which says: If the insurer is not entitled to avoid the contract or, being entitled to avoid the contract (whether under subsection (2) of otherwise) has not done so, the liability of the insurer in respect of a claim is reduced to the amount that would place the insurer in a position in which the insurer would have been if the failure had not occurred or the misrepresentation had not been made.

The argument which the insurer makes is that if the relevant information had been disclosed the insurer would not have accepted the risk. As a result, the insurer says that they are entitled to cancel the policy back to inception. This means that the insurer is entitled to deny any claims made under the policy. However, the insurer has to refund the premium. If the non-disclosure was made 3 years ago, the insurer is required to refund the premium for those 3 years.

Insurers do not communicate their underwriting criteria to brokers and criteria does vary between insurers and sometimes the same insurer will have different criteria for different products.

For example:

- Some insurers will decline a building risk if the building contains asbestos; others will accept those buildings. The same issue arises with EPS.

- Sometimes, insurers who own systems can produce different outcomes depending on the policy selected. In one recent claim, an insurer accepted a particular risk under one policy (a domestic landlords policy) but declined it under another policy (a commercial landlords policy) on the grounds that they would not accept a building with wooden construction under the commercial policy (they did under the domestic policy).

If an insurer relies on non-disclosure to deny a claim and the dispute ends up in FOS or court, the insurer will need to be able to prove its underwriting criteria from the documentation.

For further information please do not hesitate to contact our office.

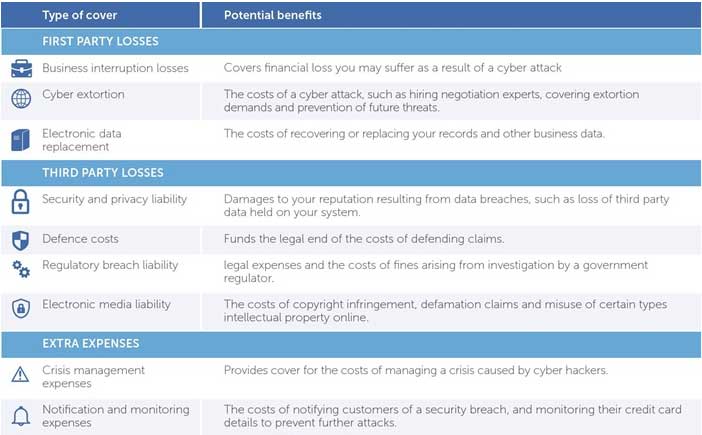

Cyber Insurance

In the last few months, there have been a number of large claims whereby a fraudster was able to access the computer system of a supplier of goods, resulting in a loss to the insured.

The fraudster used that access to create fraudulent documents which were provided to the insured, who then paid money to the fraudster in reliance on those documents.

In the most recent claim, an Australian company was purchasing goods from a supplier in India. A fraudster hacked into the Indian company’s system and generated an invoice directed to the Australian company in the amount of US$260,000. The Australian company was expecting an invoice from the Indian company in that amount and so paid the invoice. All of the details in the invoice were correct except that the fraudsters had inserted their own bank account number.

Some Management Liability Insurance policies have a Cyber Insurance extension however we are not aware of any Management Liability policy in the market which would cover the loss in these circumstances.

To obtain a quotation for a Stand-alone Cyber policy that does cover Cyber Theft please contact us to arrange a no obligation quotation.

Don't Just Sign!

Why you should always review your contract

A builder sub-contractor won a job to do some work on a large company’s factory complex. The builder did not appreciate that the contract he signed included an Indemnity to the customer to reimburse any costs to them that they, the factory owner, may be required to pay for any claim, dispute or action arising at the construction site. During construction, a delivery vehicle being driven by one of the employees of the factory owners, struck and injured two workers who were neither employed by the factory or the builder contractor who signed the Indemnity. The injured workers claimed off their WorkCover insurer and WorkCover, in turn, recovered from the factory owners for the injury due to their employee driver’s negligence. The factory then, citing the contract, sought payment from the builder sub-contractor owner. He claimed that this was not fair but the courts found the contract was valid and he was ordered to pay $700,000 under the contract, plus legal fees for the court case. He attempted to claim under his Business Insurance policy, Public Liability section only to find that a Contractual Liability exclusion clause applied and his insurer refused to pay the claim. Not only did the business fail but the builder lost his family home!

Before signing a contract speak to Fitzpatrick & Company Insurance Brokers for obligation free advice. Be sure to obtain a copy of Manning’s Guide to Contract Reviews written by Prof. Allan Manning, published by LMI Group.

Daniel Holmes AUG 2015